The company group is strictly compliant with laws, regulations and social norms.

-

Basic policy

At Hokuhoku Financial Group, we regard compliance as one of our most important management priorities, fully recognizing that the incompleteness of compliance could weaken our business foundations. The Board of Directors has established basic compliance policies and we strive to engage in business activities in a fair and honest manner.

Basic compliance policy

-

1.Recognition of the company group’s basic mission and social responsibilities

As a regional financial institution, the company group recognizes its public mission and social responsibilities, and strives to establish trust inside and outside the company through sound business operations.

-

2.Provision of high-quality financial services

We contribute to stable regional economic and social development and the enhancement and improvement of customers’ lives by providing high-quality, comprehensive financial services.

-

3.Strict observance of laws, regulations and rules

We observe laws, regulations and rules strictly, and conduct business in a fair and prudent manner so that we do not deviate from our own corporate ethics and social norms.

-

4.Rejection of anti-social forces

We contribute to a sound society by refusing to tolerate anti-social elements that threaten social order and safety, and responding to them resolutely.

-

5.Ensuring management transparency

We strive for accurate and smooth information disclosure and decision making and aim for a highly transparent management and organizational culture.

Systems

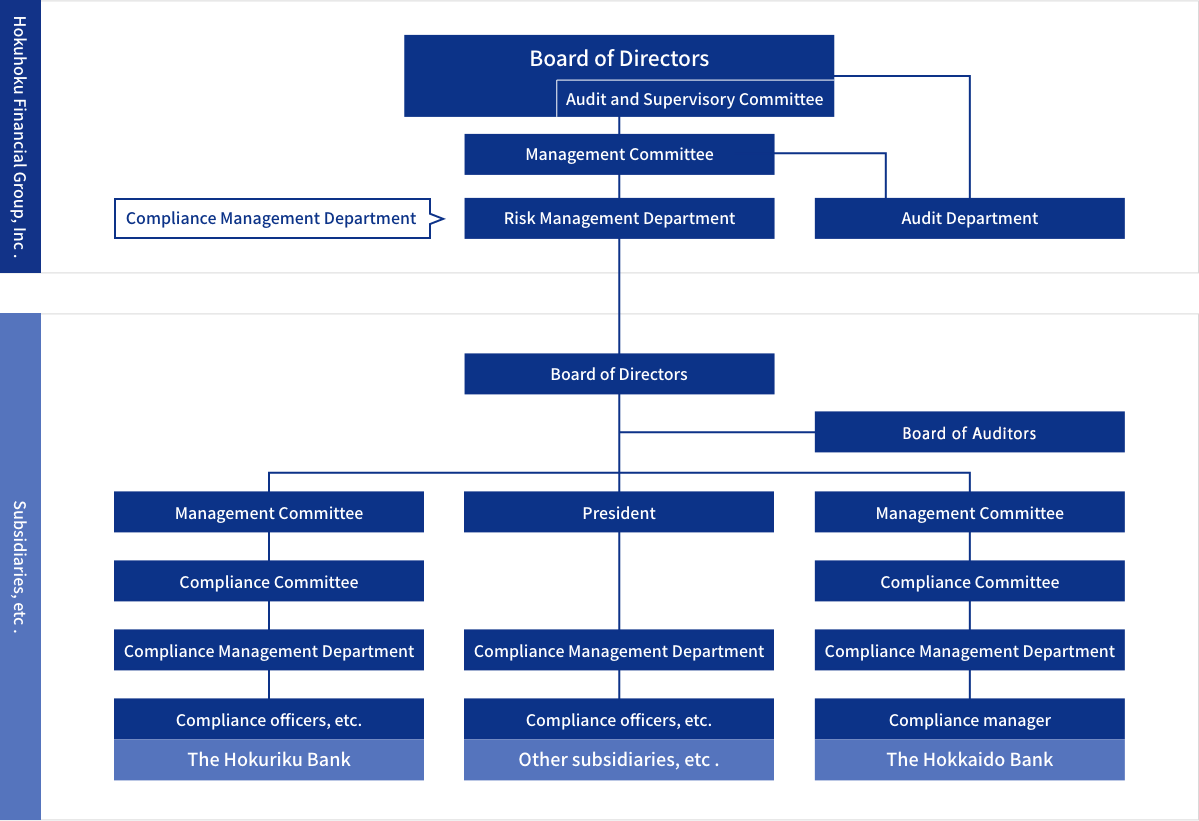

To establish compliance systems, the company group has established Compliance Rules, put in place organizational structures, and the company and each group company take measures in cooperation.

Risk Management Department is the department responsible for overseeing compliance within the group, and the head of Risk Management Department is the person responsible for compliance.

Compliance officers, etc., are assigned to each branch of the subsidiary banks and each group company to actively implement education and awareness-raising initiatives on compliance in the workplace. In addition, the subsidiary banks have each established a Compliance Management Department and Compliance Committee to grasp the state of compliance and make improvements

Compliance manual and compliance programs

To ensure the thorough implementation of compliance, we have formulated a Compliance Manual (Code of Conduct) bringing together all of the basic matters that executive officers and employees should observe. This manual is distributed to all executive officers and employees, and we make the content known to them in training and internal study meetings.

In addition, each year, the Board of Directors determines the Compliance Program, a detailed action plan for the maintenance of compliance systems, while the Board of Directors also receives reports on the state of implementation of the program regularly and strives for the certain practice of compliance.

Measures for better customer protection and greater customer convenience.

To protect customers’ assets, information and other interests, the company group has established a Policy on the Management of Customer Protection within its Basic Rules for the Management of Customer Protection.

Furthermore, to provide appropriate explanations to customers in accordance with the Japanese Financial Instruments and Exchange Act and other laws, and to respond appropriately to customers’ inquiries and complaints through Customer Consultation Office, we have formulated rules from five perspectives and established a framework to respond appropriately.

In addition, the Compliance Management Department of each group company is the department responsible for the management of customer protection, and they operate in cooperation with other departments through a framework that enables them to draft and implement various improvement measures through ongoing reviews, problem resolution and data analysis so that management systems function fully.

Measures for protection of personal information

In financial business, ensuring the safety of information assets is an essential and important matter for obtaining customer trust. As such, we protect and use all customer information in our custody strictly and prevent its leakage.

With regard to personal information, in particular, the company group has established a Personal Information Protection Declaration, disclosed on our website, to comply with the Personal Information Protection Act and other laws, and we strive so that we can obtain the maximum trust from customers as a financial institution that contributes to local communities

- Explain to the customer

- When carrying out transactions with customers, we will explain and provide information on financial products adequately and fully in accordance with laws and regulations.

- Customer service support

- We will listen carefully to customer inquiries and complaints and handle them appropriately and fully.

- Protection of customer data

- We will acquire information concerning customers lawfully and manage it safely in accordance with the law.

- Outsourcing

- When outsourcing operations related to transactions with customers, we will manage service providers appropriately to protect customers' information and interests.

- Conflict of interest

- We will manage appropriately transactions involving customers where conflict of interest could be an issue so that customers' interests are not harmed unjustly.

Measures for dealing with anti-social forces

The company group has established a Basic Policy for Responding to Anti-Social Forces to maintain the public’s trust and the appropriateness and soundness of our financial services.

In addition, each group company has assigned managers to respond to anti-social forces, takes resolute measures in cooperation with the police, etc., and severs all relations with anti-social forces that threaten the order and safety of civil society.

Internal notification system

The company group has established a whistleblower and consultation hot line and a framework to strengthen compliance also including checks and balances to detect and correct unfair practices promptly.

The prevention of money laundering and measures to deal with financial crime

The company group positions measures for the prevention of money laundering and other financial crimes as an important management issue, has clarified the division of roles within the company based on our Policy on the Prevention of Money Laundering, and has built a management system to implement appropriate measures in a timely manner with regard to verifying transactions, reporting suspicious transactions and managing correspondent bank relationships. In addition, we have been educating executive officers and employees through training, and striving to improve our efforts, including the implementation of audits on the state of compliance with measures to prevent money laundering, etc.

Special fraud and other financial crimes have increased and our subsidiary banks have prevented harm and strengthened security, and are also handling victims appropriately, including reimbursements based on the Act on Damage Recovery Benefit Distributed from Fund in Bank Accounts Used for Crimes.

Measures for a financial alternative dispute resolution (ADR) system

In order to respond promptly and appropriately to customer opinions and complaints, our subsidiary banks have concluded agreements with the Japanese Bankers Association. The association is a designated bank dispute resolution organization that works to resolve disputes from a fair and impartial position.